Mark Cornish, Senior Consultant – Brands

It is often the case that we follow sponsorship trends by sector such as sports, music, arts, culture and more. Sometimes, however, it is more revealing and relevant to follow trends by the investors themselves the brands. In less than a decade we have seen sponsorship spend by UK energy and utility brands decrease, whilst the number of sponsorships steadily increase.

We have seen the Big 6 energy suppliers (British Gas, EDF Energy, E.ON, Npower, ScottishPower, SSE) taking more of a back seat, whilst the challenger brands have stepped up. Sponsorship objectives are evolving, it is no longer just about awareness, image or reputation. Now it is also about engagement, adding value, education and acquisition of new customers.

HOW IT USED TO BE

It seems a long time ago when the Big 6 went Big in Sponsorship. E.ON sponsored the FA Cup and other major football assets, Npower sponsored the Football League and the Test Series. EDF Energy was of course sustainability partner of the 2012 London Games and British Paralympic Team and British Gas partnered British Swimming. In 2013, sponsorship spend by UK energy and utility firms exceeded $24m a year (according to Sponsor Globe) and was spread across 24 recorded sponsorship deals. For E.ON, Npower and EDF Energy, high profile properties delivered against their primary sponsorship goals of brand awareness and consideration.

In 2009 and during a period of increasing energy prices and a subsequent change in consumer attitudes towards energy suppliers, British Gas plunged into British Swimming with a reported £15m sponsorship over five years. British Gas certainly did not need to increase brand awareness, this sponsorship was all about engaging with consumers and building likeability and affinity.

The success of Britain’s elite swimmers such as Rebecca Addlington, brought a very likeable public face to the British Gas brand, whilst the numerous grassroots campaigns over the duration of the sponsorship enabled more than 1.5m people to swim for free and become more active. Given the success it was somewhat surprising when the British Swimming deal was not renewed, or that British Gas has not since ventured into a new high profile sponsorship.

In more recent years SSE has been the only one of the Big 6 to continue to develop and invest in a wide range of sponsorship properties. Based upon a brand promise of ‘Proud to make a Difference’, SSE has the naming rights to four world-class arenas staging sports, music and comedy. These arena’s naturally fit with the geographic footprint of SSE customers who benefit from rewards schemes, whilst SSE’s acclaimed sponsorship of Women’s football has gone onto win industry awards and grow in scale.

Most recently Npower stepped up in January 2018 to support Team England’s bid for Commonwealth Games glory. The initiative focussed on getting behind the athletes through the ‘Power of Support’ campaign. Elsewhere, Irish energy companies SSE Airtricity, Bord Gáis Energy and Energia have all invested in local sponsorships across GAA, Football and Rugby.

CHALLENGER BRANDS PICK UP THE SPONSORSHIP BATON

As most of the Big 6 pulled back on sponsorship, so the spend from the industry dropped from 2013 – 2018 by 47% to $13m per year. However, what is more relevant is that 22 energy or utility brands now sponsor, almost double that of 2013. In short, more brands have been active across a range of lower investments.

Most sponsorship investments today are made by challenger brands, who have cleverly carved out partnerships that allow them to target specific groups in the UK market. Brand awareness is important, but other benefits are key, such as access to members, fans and communities, a platform to educate about types of energy available, switching supplier and special offers, are all part of the sponsorship strategy. Community investments often run alongside or as part of the sponsorship, allowing consumers to get to know and trust challenger brands. So, let’s take a look at three of the most recent challenger brands in action:

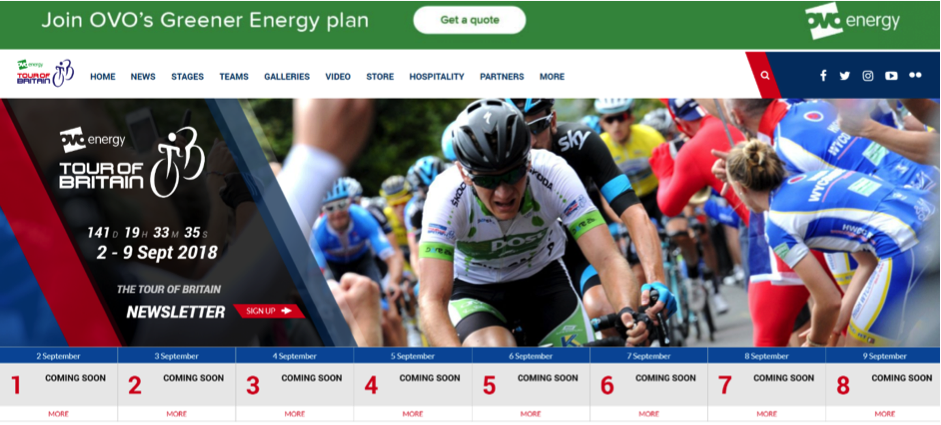

OVO ENERGY announced title sponsorship of the Tour of Britain, Women’s Tour and Tour Series in September 2017. This was a step up from sponsoring a stage on the tour last year and clearly shows that this initial investment has given OVO Energy the confidence to take on a major set of cycling rights in the UK. OVO Energy sees a good fit between cyclists and its savvy customers who are looking for greener solutions.

For UTILITA it all started in 2015 with a sponsorship of the Scottish League Cup. Today, Utilita now have an astonishing 20 football partnerships from the premier elite of Crystal Palace, Rangers and Southampton FC, through the Championship ranks to non-league football at Eastleigh FC.

Jem Maidment, Utilita’s Director of Marketing & Communications has driven these partnerships and passionately believes sponsorship is the right platform for the business and the brand. Utilita, like all new brands recognises the need to build awareness and compete with the Big 6. Utilita tactically applies sponsorship in geographic areas where they can grow their business. Once engaged, Utilita are quick to become part of the fabric of the community.

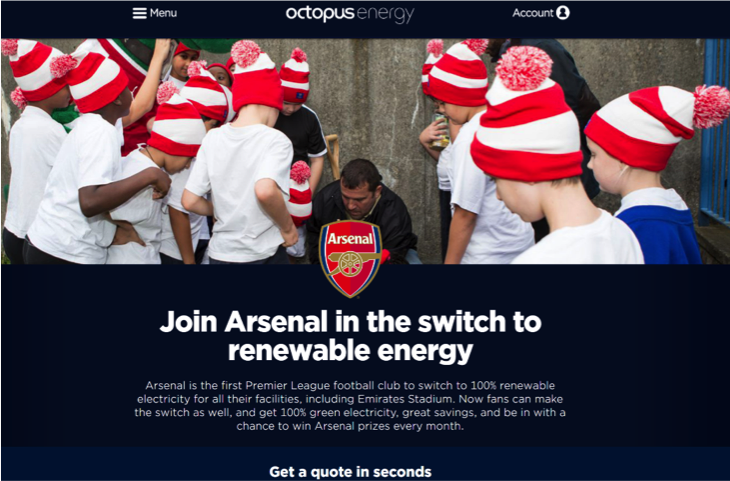

OCTOPUS ENERGY the solar power specialists initially became a sponsor of Arsenal in October 2016. The purpose of the deal was to help Arsenal transition to 100% green energy. Octopus has been instrumental to helping Arsenal and now provides solar energy to the club saving 2.32 million kilograms of carbon dioxide.

A new deal was signed in August 2017 which now means Arsenal fans can benefit from great savings and special prize draws. This sponsorship is raising Octopus Engergy’s profile and credibility, along with the potential to generate direct ROI.

In all three cases, these challenger brands have carefully invested in sponsorship and over a period of just three years grown their sponsorship portfolio and spend significantly. Why? Because it works. If this trend continues then more sponsorships from this sector are likely to flourish and with it increasing spend, above and beyond the previous years.

CONTACT

Mark Cornish

Senior Consultant – Brands

Nielsen Sports & Entertainment