Nielsen has analysed branding opportunities afforded to clubs and their partners on netting in the lower tiers of stadia across the main value-driving media platforms, linear TV, OTT and to a lesser degree, social media. The analysis is based on pre-COVID coverage and viewing behaviours and represents value delivered to partners should the status quo remain.

Nielsen’s Whitespace Valuation service provides systematic analysis of in-stadium spaces to help determine the media exposure value over an entire season of game play. In addition, the service calculates proprietary Quality Scores for each brand exposure during a TV broadcast based on sponsor logo size and location, duration of logo exposure and multiple brand hits.

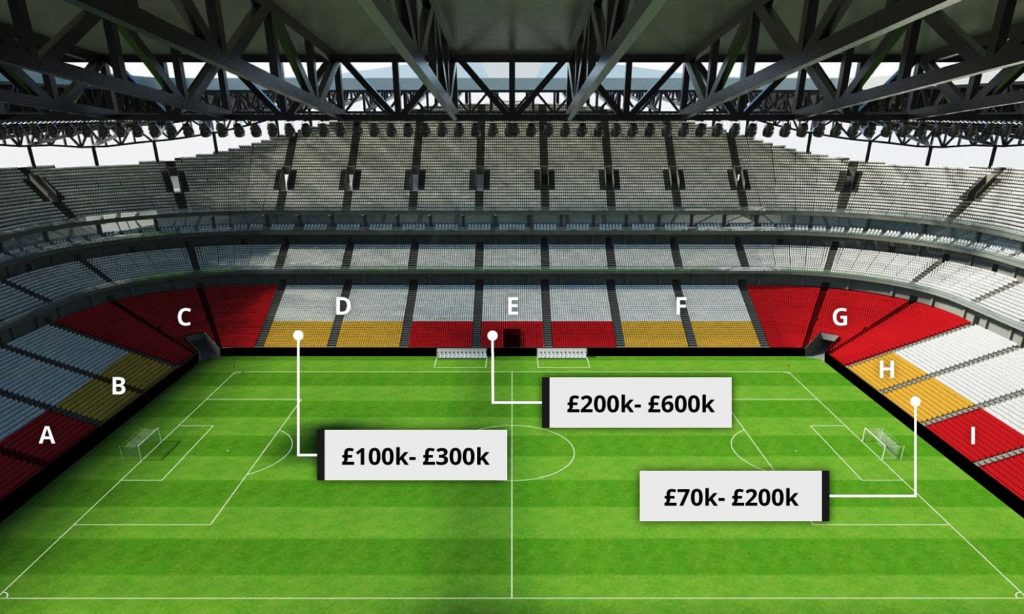

Broadly across Premier League clubs, partners could expect to receive global value between £700k and £2m per match assuming their branding repeats several times across the sidelines and behind goals. Our analysis indicates that the zones on either side of the halfway line could generate anywhere from £200k to £600k per match. To put this into context, this would be more than a principal partner may generate on the LED board – typically one of the most valuable branded assets in football.

Given that linear TV is the primary value driver for most clubs, the changes to the restart schedules could have a significant impact going forward. There is a widely accepted notion that viewing across Sky Sports and BT Sport will increase versus the season average – although by how much remains to be seen in the coming days and weeks. (Look out for a follow-up piece from Nielsen on the impact changing TV audiences will have on the league, teams and sponsors.)

It is too early to sensibly suggest other branding value will increase significantly based on the fact all matches are being broadcast in the UK even though it is one of the most valuable TV and OTT markets. This is because the dilution of the value per match metric is a real factor in overall value, even though coverage is set to increase significantly. The real indication of whether this will grow even more is the continued coverage and viewing of all remaining matches internationally. European broadcasters have the rights to increase their coverage (in line with the UK) which in markets such as France, Norway and the Netherlands could provide further value delivered to sponsors.

For information regarding this article please contact know@nielsen.com