It’s a big year for rugby union as the sport welcomes two of its major events in the same year, the Guinness Six Nations, which kicks off tonight, and the Rugby World Cup in September. Both events generate significant interest and audiences that lead to strong exposure for brands and sponsors involved.

With the start of the Guinness Six Nations just around the corner, we’ve seen a steady increase in fans either ‘very interested’ or ‘interested’ in the sport. Interest in rugby union has seen a 7% increase between 2017 and 2018 in the Six Nations markets, according to Nielsen Sports’ SportsDNA.

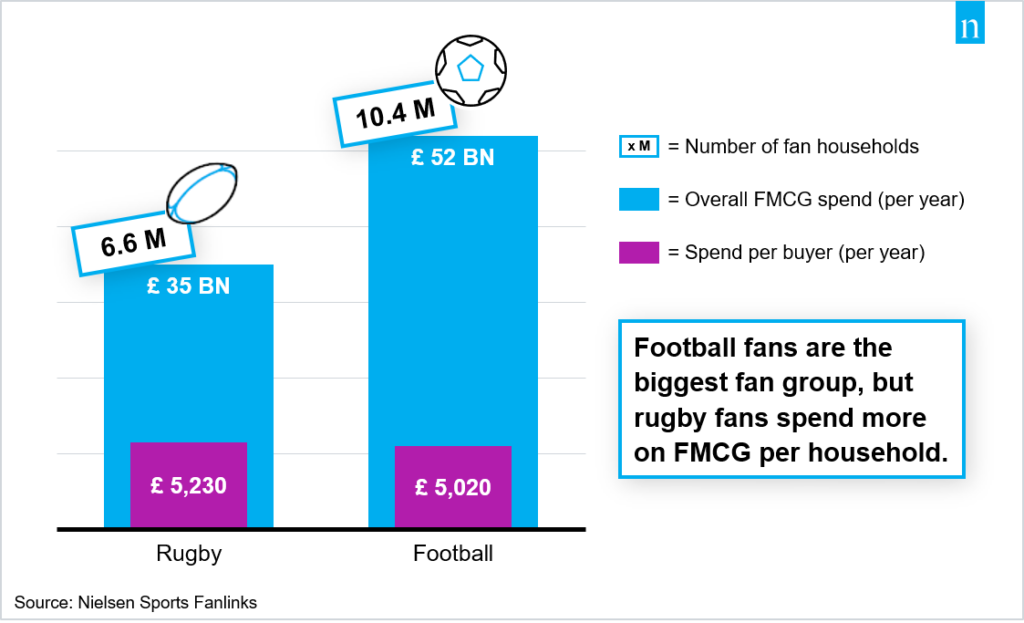

Interestingly, when delving into Nielsen Sports’ Fanlinks, where we are able to combine the purchase behaviours of UK households with their fan interests across sports and entertainment, we can clearly prove what brands sports fans are buying. Overall, UK households interested in rugby spend £35bn a year across the fast-moving consumer goods (FMCG) sector.

SO WHAT DOES THIS MEAN FOR BRANDS?

Many would assume that rugby fans traditionally spend more on beer and lager than any other fan group, or even the general population. What’s fascinating to see though, however, is how we can shift from ‘claimed’ to ‘actual’ data and identify what brands rugby fans are spending on.

It’s a well-known fact that football is the most followed sport in the UK, which is why it represents a good benchmark for rugby. When comparing the household interest by sport, football’s annual spend on FMCG products sits at £53bn compared to rugby’s £35bn. The key opportunity revealed here is that per buyer, rugby fan households spend more than football fans each year (£210 more than football fans).

Across the UK, Stella Artois is the most popular beer and lager brand in rugby fan households. Last year Guinness replaced Royal Bank of Scotland as title sponsor of rugby’s Six Nations tournament. When looking at Nielsen Sports’ sales and consumption data, Guinness is ranked the third most popular beer and lager brand among the UK, as well as households that follow rugby.

The question now is, will consumption of Guinness change over time as a result of the partnership and how can we tangibly measure this?

Leveraging the power of Fanlinks, Nielsen Sports is able to quantify sports fan purchasing behaviour by brand and deliver specific retail strategies in line with the best opportunities in sponsorship and rights holder partnerships. This enables brands and rights holders to reach the most appropriate sports consumer. Furthermore, brands can measure the success and align their products within potential partnerships that provide return on investment into the future.

AS THE COMPETITION INTENSIFIES

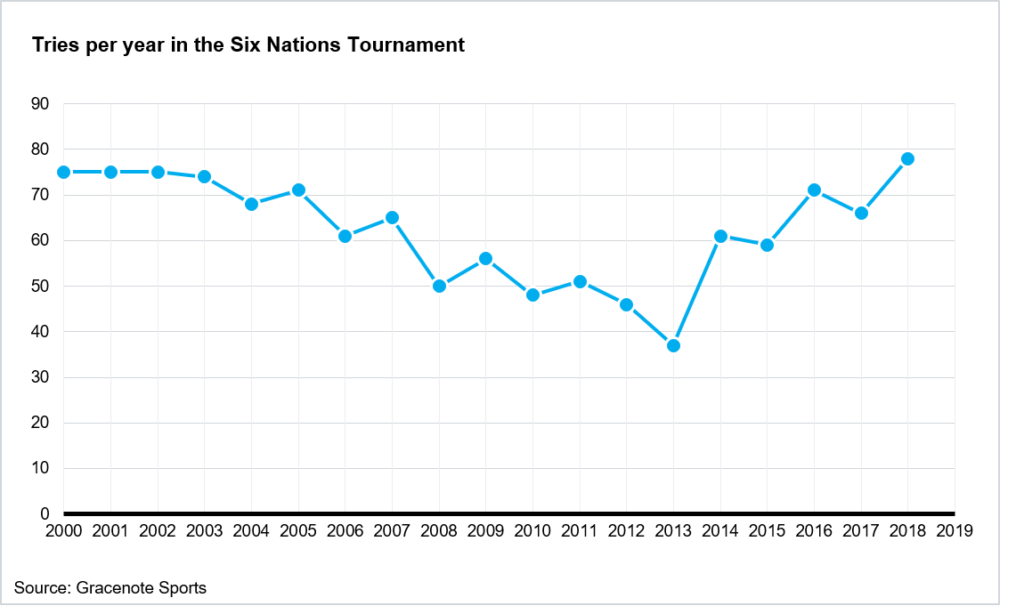

The 2018 Six Nations Championship was the eighth in the 19 years since Italy joined in which there were no matches won by at least 40 points. The biggest win was Ireland’s 56-19 win against Italy, according to Gracenote Sports.

The average points difference of 14 across the 15 matches in 2018 was the lowest since the 2013 Six Nations Championship.

Eight of last year’s 15 matches in the Six Nations Championship were won by 10 points or fewer. Competitive matches have been a feature of the competition for the last 14 seasons with generally around half of the fixtures having 10 points or fewer between the teams.

Seven of the 10 matches between the original Five Nations in the 2018 Six Nations Championship were won by 10 points or fewer. This was the fourth successive year there had been so many close matches involving these five teams. Excitement is more or less guaranteed when the bigger sides meet.

Try scoring in the 2018 Six Nations Championship was up to 78 tries, breaking the record set in 2000, 2001 and 2002 (75). The Six Nations is therefore not only very competitive at present but also higher scoring than ever before.

In summary, the more competitive the Guinness Six Nations becomes the more likely it is that we’ll see a strong spike in interest across the UK and Europe. This will also lead to more eyeballs tuning in to watch, furthermore, creating a unique platform for rugby union and sponsors alike.

Knowing how to justify commercial decisions leads to businesses being much more selective about the partnerships they choose. Within sports sponsorship, Nielsen Sports monitors the purchasing habits of consumers providing tangible sales data, matching them with the direct impact sponsorship has during the path to purchase.

Fanlinks

Read about Nielsen Sports’ Fanlinks for both brands and rights holders to understand more:

For further information, please contact:

Richard Seymour

Head of Consulting, UK

richard.seymour@nielsen.com