Nielsen’s review of 2019 ratings in the US shows that almost all of the most-watched content is from the traditional sport behemoths. So it might seem surprising that there is little complacency in the boardrooms of major sports rightsholders that I’ve visited recently around the world.

The dawning reality is that the coming generation, those now aged 16-24, are far from certain to slot neatly into the lucrative sports consumer franchise developed since the invention of mass media in the 1950s. Declining attendance and viewership is already a reality for those not evolving quickly enough. It is time to act.

There are a number of key differences with this new generation which stem from the environment they’ve grown up in. They have higher expectations for entertainment experiences than their elders, and new ways to discover and consume content.

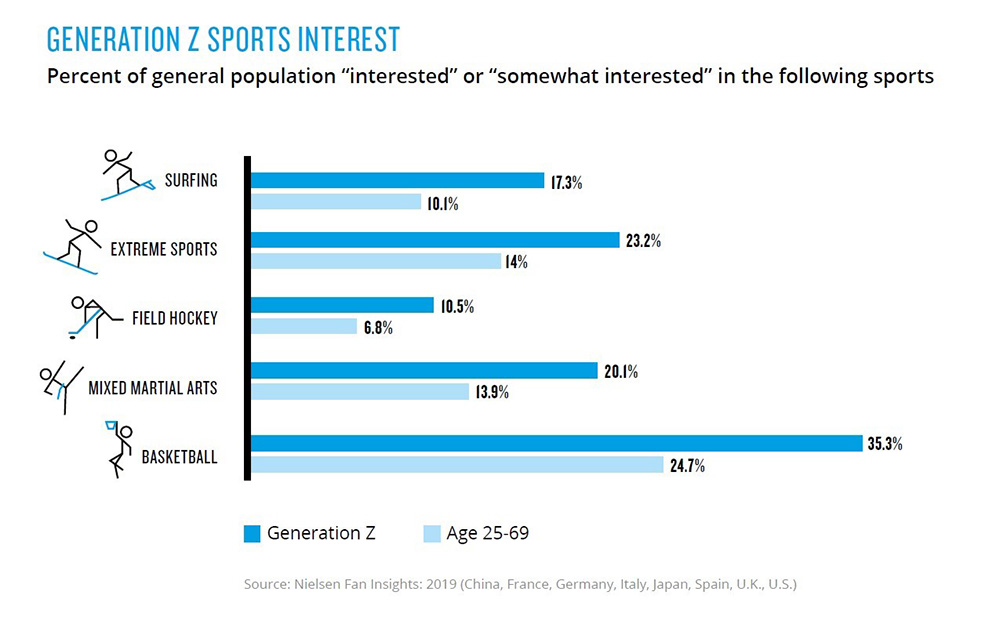

Data from the Nielsen Fan Insights study across eight different markets (China, France, Germany, Italy, Japan, Spain, the UK and the US) reveals that those aged 16-24 prefer shorter, “snackable” content and, from a sporting standpoint, are less inclined to watch entire games.

Gen Z sports consumption trends

This doesn’t mean that their attention spans are shorter – if the content is sufficiently engaging and provides regular opportunities to interact, they are still prepared to invest meaningful time. Fans of watching online video gaming in the US provide a case in point – 29% under the age of 25 state that they watch continuously for one to two hours, whilst 14% watch for three to four hours at a time.

Another myth worth busting is that this generation has no money, or is unwilling to pay for content. Our research shows Gen Z consumers are not averse to paying for premium content, but they are increasingly expecting a tailored value proposition – that is, they want to be able to pay purely for what they want, where and when, and without any long-term contractual commitment.

Largely for these reasons, they are helping to drive the increasing tendency amongst consumers to ‘cut the cord’ on traditional pay-TV subscriptions. And what they want to watch is also shifting towards a larger share of more authentic original content, for example behind-the-scenes, documentaries, etc. They want to be closer to their favourite sports and players beyond just watching a game or a sporting event.

The growth in the streaming of live sport does not necessarily equate to the demise of big screen viewing, though – for example, DAZN states that almost two-thirds of consumption of its platform is still via the TV, with mobile devices only used when necessary. In Australia, 58% of viewing on the Kayo Sports OTT service since launching in November 2018 has been via the big screen. And, of course, a larger proportion of this new generation is still living at home, compared to previous cohorts, so will be watching on the family big screen or escaping to the local sports bar.

What does this mean for sport sponsors?

The new generation, less burdened by rent, have more disposable income than you might suspect, and are generally more brand conscious. Our research shows they are more likely to be in the market for luxury and tech brands than their older friends, and this is particularly true in emerging markets like China. So Louis Vuitton’s partnership with Riot Games’ League of Legends esports competitions and Tissot’s sponsorship as the official watch of the NBA make perfect business sense.

For brands with less obvious tech or luxury appeal, this is also the generation that has grown up with a different expectation for following social causes. We see insurance companies with an increasing focus on sponsoring endurance sports as a way to promote healthy lifestyle, adidas cleaning plastic from our oceans and sports personalities – brands in their own right – donating to Australian bushfires charities.

Above all, they don’t fit neatly into the “hard-core sports fan” persona that much of the sports marketing industry has been built to target. They expect to participate socially and creatively with sports content, and the traditional tactics for driving loyalty and monetisation will be less effective.

Perhaps rather than fighting the decline of the core, it may be more rewarding for sports organisations to re-think how to engage the much larger population of more peripheral fans in this group. Embrace the fact that they have many other interests, focus on digital accessibility, creative/social interactivity and positioning sport firmly in the context of the broader entertainment choice.

Get this right, and Nielsen will be showing sports content dominating ratings for long into the future.

Want to know more?

Contact us if you would like to know more about the ever-changing sponsorship landscape and the impact these trends will have on your business.

Download our free Commercial Trends in Sport snapshot.

Mike Wragg, EVP, Global Head of Research, Nielsen Sports

mike.wragg@nielsen.com